Adani Is Building a $1.5 Billion Property Empire to Reshape India

July 22, 2025 in Property Guide

The billionaire's firm is snapping up distressed construction companies and winning major redevelopment deals, including the high-stakes overhaul of the Dharavi slum.

Billionaire Gautam Adani’s ports, power and cement businesses have made him Asia’s second richest person. Now, he’s quietly building a multi-billion dollar real estate empire that’s reshaping one of the world's most expensive property markets.

Since 2010, his real estate arm has expanded its footprint across major tech and finance hubs in India, from a country club and township in Ahmedabad to luxury towers in Mumbai. Adani Realty is now one of the country's largest property players and is worth about $1.5 billion, according to the Bloomberg Billionaires Index, which has valued the business for the first time.

Using a two-pronged strategy to expand its property assets, the firm is both snapping up distressed construction companies at bargain prices and aggressively bidding on government redevelopment projects.

It's the latter that has landed Adani one of the most ambitious — and high-stakes — prizes in Indian real estate: the right to transform Dharavi, one of the world's largest slums, into a modern Mumbai township.

"Mumbai holds a pivotal place in our growth strategy, both as a real estate market and as a city of global significance," Pranav Adani, Adani Realty managing director and Gautam Adani's nephew, said in an emailed response to Bloomberg News. He declined to comment on the valuation.

Adani's project vehicle, Navbharat Mega Developers Pvt., will develop 151 acres (61 hectares) of Dharavi's 641-acre sprawl to rehouse residents — an effort expected to cost the firm $11 billion over seven years, according to a state government presentation on the masterplan in May. Another 118 acres can be used for offices and apartments that will be sold on the open market, with the rest allocated to public infrastructure, the presentation said.

?height=400&width=800)

Given the complexities of construction and rehoming people, Adani may be able to develop between 21 million and 60 million square feet of property and sell it on the open market. At 20,000 rupees ($232) a square foot, that may generate as much as $14 billion in revenue for Navbharat, in which Adani holds an 80% stake, with the rest owned by the state government. Assuming an industry-average profit margin of 25%, the project would net up to $3 billion for Adani.

But this excludes various infrastructure fees, taxes, interest, inflation and other costs.

Navbharat also needs to maintain the infrastructure and the residences for 10 years after construction and will pay the financing cost until it can sell the properties, Pranav Adani said.

But before any profit can be realized, Adani must overcome the immense social, legal and logistical hurdles involved in the urban renewal project.

"From the outside it looks like Adani will make a windfall, but the reality is that it is a high cost and high risk project," said Pankaj Kapoor, managing director of Mumbai-based real estate research firm Liases Foras.

Still, the slum redevelopment offers Adani the chance to define his legacy in his home nation, where his conglomerate has a bold slogan that translates into English as 'we will deliver.' Adopted soon after short-seller Hindenburg Research accused the group of fraud, the promise of efficient execution — if realized — may help shore up investor confidence and bolster the brand as Adani lobbies Washington to drop criminal and civil charges over an alleged bribery scheme. The Adani Group has denied all allegations.

Adani has called the redevelopment a "transformative project," saying at the annual meeting of Adani Enterprises Ltd. in June that more than 1 million people will move from "narrow lanes to a township that will feature spacious layouts, dual toilets, open spaces, schools, hospitals, transit hubs and parks."

?height=400&width=800)

Top Player

Even without Dharavi, Adani Realty is rapidly expanding its footprint, positioning itself as a formidable challenger to India's top developers — billionaire KP Singh's DLF Ltd., the Lodha family's Lodha Developers Ltd., and Godrej Properties Ltd. A potential future stock listing may also unlock billions in value for the Adani family.

"We periodically assess strategic options," Pranav Adani said in his response. "Having said that there is no immediate plan for going public," he added.

?height=400&width=800)

The Adani Group is also the frontrunner to acquire Jaiprakash Associates Ltd., people familiar with the matter previously told Bloomberg News — a move that would add real estate assets to its portfolio. Jaiprakash's lenders are overseeing the sale and assessing the bids under India's bankruptcy law.

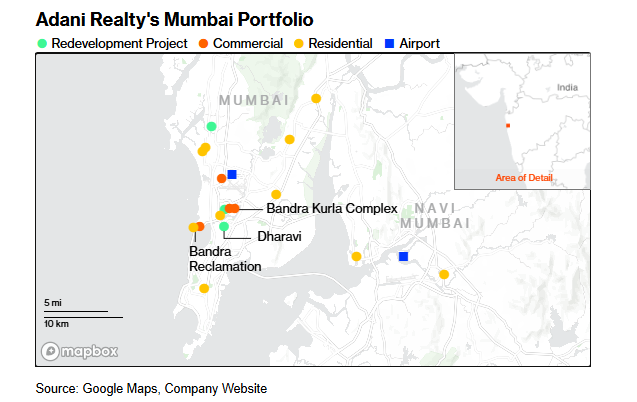

Today, Adani Realty has more than a dozen projects underway across Mumbai. Several of these were previously stalled due to litigation or financial distress before Adani stepped in and acquired them — often at a discount. This strategy has allowed the firm to scale quickly and cost-effectively.

In January 2023, Adani acquired the insolvent real estate firm Radius Estates and Developers Pvt. for $9 million, after it had defaulted on $330 million in debt. Radius had struck a deal to rehouse 176 families from an old apartment site near the Bandra Kurla Complex — Mumbai's main business hub — while also selling several hundred new units on the open market.

The project had stalled in 2020, leaving homebuyers in limbo. Adani revived it by injecting more than $50 million in fresh funding and restarting construction. Today, the $530 million, 15-tower development — branded 'Ten BKC' — is a massive presence on the skyline, visible even from northern Dharavi.

Adani revived the development by injecting more than $50 million in fresh funding and restarting construction. Photographer: Dhiraj Singh/Bloomberg

Redevelopment Projects

In the last two years, Adani Realty has secured major government projects in Mumbai, including a $4.1 billion housing development in the north of the city and a $3 billion residential and commercial complex overlooking the Arabian Sea in the upmarket suburb of Bandra West. Adani is also monetizing land around the Mumbai and Navi Mumbai airports as commercial offices, hotels, restaurants and entertainment facilities.

The company also bagged redevelopment and slum rehabilitation contracts from various agencies in the financial capital. These projects have less regulatory obstacles thanks to the states' involvement and the developer receives rights to develop apartments to be sold on the open market.

But Dharavi is on another scale altogether.

In 2022, Adani won the contract to redevelop the area, pledging to invest over 50 billion rupees in equity upfront. The first phase of the project will cost more than $1.5 billion and will involve Navbharat constructing houses — including 15,000 tenements — and offices on railway land adjoining the slum.

Famous as the location for the film Slumdog Millionaire and frequented by tourists, Dharavi is a densely populated, informally developed maze. Home to more than a million people and thousands of micro-industries, the area is a chaotic mosaic of overlapping property rights, communities and small businesses.

"The city's center of gravity is moving from the south towards the center and infrastructure is being planned in a way that Adani will become the biggest beneficiary," Vinod Shetty, a labor lawyer and director of Acorn Foundation (India), said.

At the heart of the project lies a simple equation: Adani must first build and hand over thousands of free apartments and infrastructure — roads, sewerage, gas and electricity lines, schools, even a hospital — before realizing any revenue from the project's profitable component.

Only after relocating eligible residents within a stipulated seven-year time-frame can Adani build residences and offices on a portion of land allocated for commercial sale. That land, known as the "free sale" component, is expected to yield luxury apartments and office space that may generate substantial returns.

But the size of that windfall depends on how efficiently Adani can navigate the city's regulations, minimize resistance from residents and avoid delays that would inflate financing costs.

For Pranav Adani, Mumbai and the project hold a pivotal place in the firm's growth strategy.

"Dharavi represents more than just a redevelopment initiative," he said. "It is a chance to reimagine inclusive urban living at an unprecedented scale."

This article is sourced from: Bloomberg

Looking for dream spaces, not sure where to start?

Leave us a query and our representative will get back to you.

Disclaimer

The Adani Realty expressly disclaims all liability in respect to actions taken or not taken based on any or all the contents of this Blog. The content of this blog is collation of data from various sources and is provided only for information purpose only and Adani Realty does not canvass the particulars, information, brand or any other materials mentioned in the blogs nor does it obtain any monetary benefit from the same.The Adani Realty shall in no circumstance be held liable for any expense, loss or damage including, without limitation, direct, indirect or consequential loss or damage, or any other expense, loss or damage whatsoever arising from the use of data, information, interpretation, judgement or opinion arising out of or in connection with the use of this Blog. Reader is advised to read and apply his/ her intellect and discretion in this regards.